Understanding Cryptocurrency Fundamentals

Master the essential concepts of digital currencies, blockchain technology, and the revolutionary world of cryptocurrency

What is Cryptocurrency?

Cryptocurrency represents a revolutionary form of digital or virtual currency that uses cryptographic techniques to secure transactions and control the creation of new units. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology, making them resistant to government interference and manipulation.

The first and most well-known cryptocurrency, Bitcoin, was created in 2009 by an anonymous person or group known as Satoshi Nakamoto. Since then, thousands of alternative cryptocurrencies have emerged, each with unique features and use cases. For anyone interested in bit coin tracking or using a reliable cointracker, understanding these fundamentals is essential.

Key Characteristics of Cryptocurrencies:

- Decentralization: No central authority controls the currency

- Transparency: All transactions are recorded on a public ledger

- Immutability: Once confirmed, transactions cannot be reversed

- Pseudonymity: Users can transact without revealing personal information

- Global accessibility: Available 24/7 worldwide without geographical restrictions

Blockchain Technology Explained

Blockchain is the underlying technology that powers most cryptocurrencies. Think of it as a digital ledger that records transactions across multiple computers in a way that makes it nearly impossible to change, hack, or cheat the system.

How Blockchain Works:

- A transaction is initiated and broadcast to the network

- Network participants validate the transaction using consensus mechanisms

- Once verified, the transaction is combined with other transactions to form a block

- The new block is added to the existing blockchain

- The transaction is complete and permanently recorded

Each block contains a cryptographic hash of the previous block, creating an unbreakable chain. This design ensures that altering any single transaction would require changing all subsequent blocks, which is computationally infeasible on a large network.

Types of Cryptocurrencies

The cryptocurrency ecosystem has evolved to include various types of digital assets, each serving different purposes and use cases. Understanding these categories is crucial for effective cryptocurrency management and tracking.

Bitcoin (BTC)

The original cryptocurrency, designed as a peer-to-peer electronic cash system. Bitcoin remains the most valuable and widely recognized digital currency.

- Limited supply of 21 million coins

- Proof-of-Work consensus mechanism

- Store of value and medium of exchange

Altcoins

Alternative cryptocurrencies to Bitcoin, including Ethereum, Litecoin, and thousands of others, each with unique features and purposes.

- Smart contract capabilities (Ethereum)

- Faster transaction speeds (Litecoin)

- Privacy-focused features (Monero)

Stablecoins

Cryptocurrencies designed to maintain stable value by being pegged to traditional assets like the US Dollar or gold.

- Reduced price volatility

- Bridge between crypto and fiat

- Popular for trading and remittances

Utility Tokens

Digital assets that provide access to specific products or services within a blockchain ecosystem.

- Access to platform features

- Governance voting rights

- Rewards and incentives

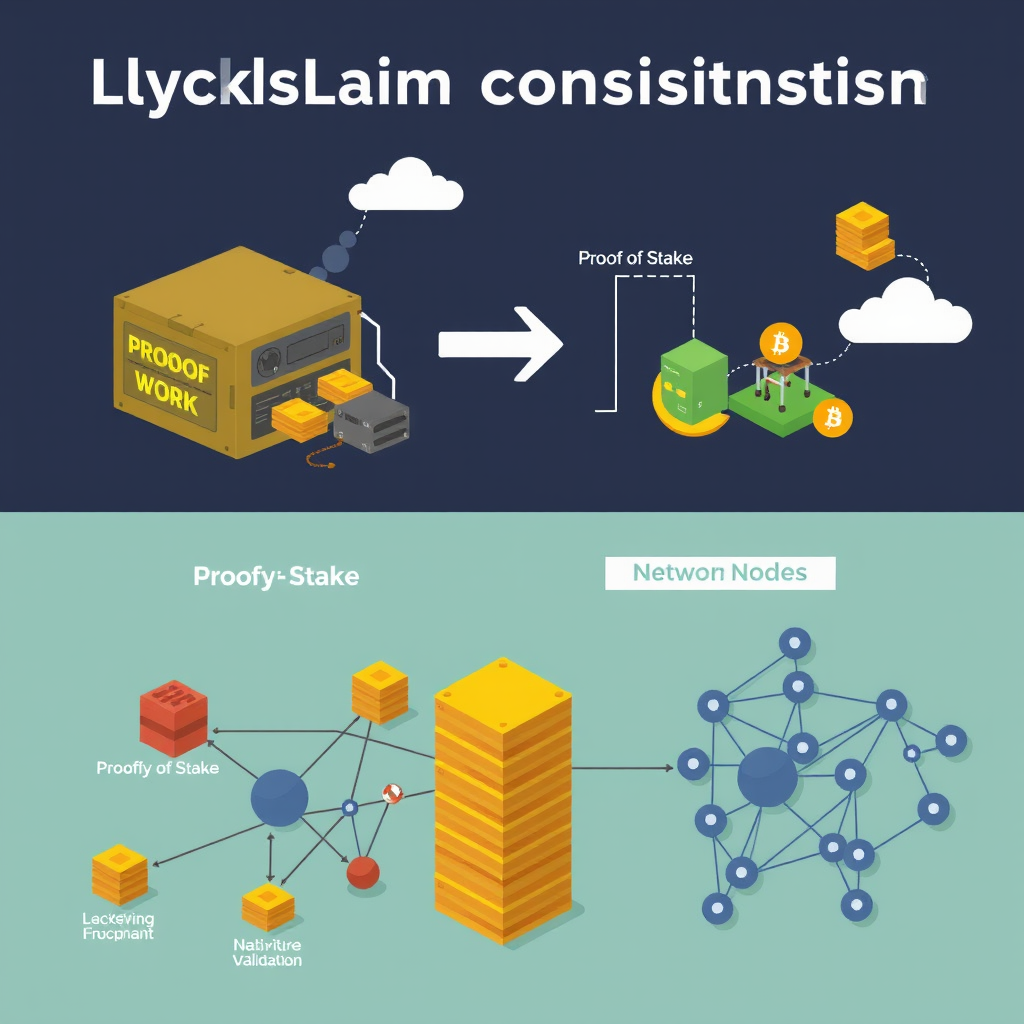

Consensus Mechanisms

Consensus mechanisms are protocols that ensure all participants in a blockchain network agree on the validity of transactions. These mechanisms are crucial for maintaining network security and preventing double-spending.

Proof of Work (PoW)

Used by Bitcoin, miners compete to solve complex mathematical puzzles to validate transactions and create new blocks.

- Highly secure

- Proven track record

- Truly decentralized

- Energy intensive

- Slower transactions

- High costs

Proof of Stake (PoS)

Validators are chosen to create new blocks based on their stake in the network, making it more energy-efficient.

- Energy efficient

- Faster transactions

- Lower barriers to entry

- Wealth concentration

- Less battle-tested

- Potential centralization

Digital Wallets and Security

Understanding how to securely store and manage cryptocurrencies is fundamental to participating in the digital asset ecosystem. Digital wallets are software programs or hardware devices that store your private keys and allow you to send and receive cryptocurrencies.

Software Wallets

Mobile and desktop applications for convenient daily use

Hardware Wallets

Physical devices offering maximum security for long-term storage

Paper Wallets

Printed private keys for offline storage and backup purposes

Essential Security Practices

- Never share your private keys or seed phrases with anyone

- Use strong, unique passwords for all crypto-related accounts

- Enable two-factor authentication wherever possible

- Keep software and firmware updated

- Verify all transaction details before confirming

- Store backup phrases in multiple secure locations

Getting Started with Cryptocurrency

Beginning your cryptocurrency journey requires careful planning and education. Whether you're interested in investment, technology exploration, or practical use cases, following a structured approach will help you navigate this complex landscape safely.

Step-by-Step Getting Started Guide

Learn the basics of blockchain technology, different cryptocurrencies, and associated risks before investing any money.

Research and select a well-established cryptocurrency exchange with strong security measures and good customer support.

Install a secure wallet application and safely store your private keys and recovery phrases.

Begin with small amounts you can afford to lose while you learn and gain experience.

Use reliable tracking tools to monitor your investments and understand market movements.

Essential Tools

- Secure wallet application

- Portfolio tracking software

- Price monitoring tools

- News and analysis sources

- Tax calculation software

Having the right tools, including a reliable cointracker for monitoring your investments, is essential for successful cryptocurrency management.

The Future of Cryptocurrency

As blockchain technology continues to evolve, cryptocurrencies are becoming increasingly integrated into traditional financial systems and everyday applications. Understanding current trends and future possibilities can help you make informed decisions about your involvement in the crypto ecosystem.

Emerging Trends

- Decentralized Finance (DeFi): Financial services without traditional intermediaries

- Non-Fungible Tokens (NFTs): Unique digital assets representing ownership

- Central Bank Digital Currencies (CBDCs): Government-issued digital currencies

- Layer 2 Solutions: Scaling solutions for faster, cheaper transactions

- Institutional Adoption: Major corporations and financial institutions embracing crypto

Key Takeaways

Cryptocurrency represents a fundamental shift in how we think about money, value transfer, and financial systems. While the technology offers exciting possibilities, it's important to approach it with knowledge, caution, and realistic expectations.

Whether you're tracking Bitcoin performance, exploring altcoins, or building a diversified crypto portfolio, understanding these fundamentals will serve as your foundation for navigating the dynamic world of digital currencies.